In the last article, you found a massive problem.

Churn in the high-net-worth (HNW) business jumped by 10% in one quarter. For a bank with one million HNW clients, that means 100,000 people walking out the door in just 90 days.

You panicked. So you jumped into brainstorming mode.

“Let’s add an app feature.”

“We need better onboarding.”

“What if we improve the dashboard?”

Ideas flew. You felt productive.

But one question went unanswered:

Which clients are actually leaving?

Without that clarity, every solution is a guess. You build features for the wrong segment. You launch campaigns that don’t resonate. Sometimes, you even accelerate the churn you’re trying to stop.

To find out who is really leaving, you have to move from assumptions to evidence.

It happens in three steps:

Step 1: Segment your clients

Step 2: Identify which segments are churning

Step 3: Understand what their churn costs you

Step 1: Segment your clients

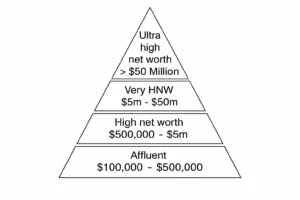

Most banks segment clients by wealth.

High Net Worth.

Very High Net Worth.

Ultra High Net Worth.

Wealth segmentation explains where the revenue sits. It doesn’t explain behavior.

If your data shows 10% of churn is happening in the HNW segment, one thing is clear: Revenue is leaving. Beyond that, the data stays silent.

Wealth bands capture financial impact. They don’t tell you how clients interact with the bank, what they expect, or why they quit.

To understand churn, you need to shift your focus. Stop looking at how much clients have and start looking at how they behave.

A practical way to do this is to segment by age, source of wealth, and interaction patterns. These factors shape how clients consume advice and build trust.

Here’s one way to approach it:

- Retired Business Owners

Exited founders in their 60s–70s with complex financial lives. They value clear ownership, continuity, and deep understanding of family and estate context. - Passive Heirs

Inherited wealth later in life. They value reassurance, careful guidance, and time to build confidence before acting. - Entrepreneurs

Active or semi-active founders. They value speed, decisiveness, and clear authority. - Professionals

Time-poor executives. They value simplicity and low-effort financial management. - UHNWI

Ultra-wealthy clients with family offices. They use banks selectively for execution and leverage.

The takeaway is simple: clients with similar wealth behave very differently. And they churn for different reasons.

Step 2: Identify which client segment is churning

Once you segment churned clients by behavior, a pattern emerges.

Retired business owners made up 45% of your clients, yet accounted for 70% of the churn.

Typically aged 60–75 and no longer active in the business, this group prioritizes capital preservation and the smooth transfer of wealth to heirs. They pay high private-banking fees, hold massive investable assets, and use nearly every product the bank offers.

Because of this scale and complexity, their expectations are different.

They value a mature Relationship Manager (RM) who clearly owns the client relationship. One person accountable for family finances, trusts, and long-term planning.

Other client segments behave differently.

Passive heirs are typically middle-aged and have recently inherited wealth. Their primary goal is maintaining their lifestyle while minimizing risk. For them, security matters more than performance.

Instead of ‘ownership,’ heirs look for guidance and reassurance. Success comes from an RM who explains options, oversees the portfolio, and advises on major decisions like tax optimization.

Treating high-net-worth clients as one segment ignores these differences and leads to dissatisfaction and silent churn.

Step 3: Understand what their churn costs you

When a retired business owner leaves, advisory fees disappear. Assets move out. Lending income drops. Even referrals dry up.

Their churn wipes out multiple revenue streams at once.

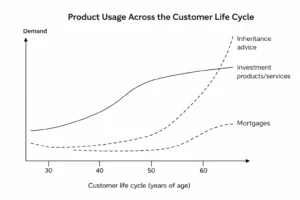

To see what’s at stake, look at client lifetime value.

Client value isn’t just today’s revenue. It compounds over time.

As clients move through life stages, their banking needs evolve. Early on, they pay basic private-banking fees. In their peak years, they drive investment growth. In the later stages, they focus on wealth transfer and estate planning.

Retired business owners generate value year after year. They bring not just revenue, but also referrals, family relationships, and long-term continuity.

Losing them weakens the bank’s core economics.

Remember the brainstorming session?

- “Let’s add an app feature.”

- “We need better onboarding.”

- “What if we improve the dashboard?”

None of those ideas addressed the real problem: who was actually churning.

To answer that, we segmented clients by behavior instead of wealth bands. The pattern became clear. Most of the churn was coming from retired business owners, the segment that generated the most value for the bank.

The brainstorming failed because it started with solutions instead of understanding the problem.

Now you know who is churning.

The next step is to understand why.

That requires interviewing the right clients. That’s where the next piece of the puzzle begins.