Have you ever watched a chef prepare before the kitchen opens?

They don’t cook each dish as orders come in. That would be chaos.

Instead, they do mise en place. Ingredients are chopped. Spices are measured. Everything is laid out before service begins.

Client interviews work the same way.

By now, you’ve debriefed interviews across four groups:

- Churned retired business owners

- Active retired business owners

- Churned passive heirs

- Active passive heirs

In total, that’s roughly 32 interview debriefs if you ran six to eight interviews per segment.

Each debrief is valuable.

But on its own, it’s like an ingredient on the counter.

Nothing useful happens until you organize them. You need to group what you heard, compare it across segments, and look for patterns. Only then can you see which problems are driving churn.

At this point, it’s tempting to jump straight to identifying the problem that caused clients to churn.

That’s risky.

Here’s why.

Risk 1: You focus on a small set of memorable answers

Some issues stand out because clients describe them with emotion and detail.

For example, if a few churned clients spent a lot of time explaining how they weren’t identified as high-net-worth clients when calling from US numbers. As a result, they were routed into regular queues, asked repeated security questions, and treated like regular clients.

That experience is frustrating.

It sticks in your mind.

But on its own, it doesn’t explain churn.

It’s easy to mistake a vivid story for the root problem.

Risk 2: You prioritize problems that affect only a narrow group

Some problems show up strongly in a small pocket of the audience but barely appear in others.

For example, younger active passive heirs wanted regular investment news from their relationship managers to feel confident before making decisions. Other segments didn’t raise this at all.

If you don’t compare problems across segments, you risk prioritizing issues that only affect a small slice of clients.

Risk 3: You miss deeper patterns entirely

The biggest risk is missing patterns that only emerge when interviews are viewed together.

One such pattern emerged around Canada–US banking.

From the client’s perspective, the request was simple. They were moving money between two accounts within the same bank. They had one relationship and expected the bank to handle the complexity behind the scenes.

Inside the bank, things worked differently. The Canadian and US businesses operated as separate regulated entities. The Canadian relationship manager held the full client context. Cross-border transfers triggered additional approvals on the US side.

That split created a gap.

When the relationship manager was unavailable, no one else had the context or authority to approve the transaction.

From the client’s point of view, this fragmentation was invisible but costly. They experienced one bank, yet progress depended on a single person being available in one country.

This pattern only became visible when interviews were examined together.

More importantly, the pattern revealed something deeper.

Some problems aren’t surface-level service issues. They stem from how the business operates and how responsibility is divided across teams and borders.

Understanding those problems takes time. It requires conversations with senior relationship managers, operations teams, and compliance partners. This is not something to rush.

Because of these risks, you need to step back and look across all 32 interview debriefs and all four segments.

Here’s how to do that in three steps.

Step 1: Group problems within each client segment

Start by reviewing interview debriefs one segment at a time. For each segment, list the problems clients mentioned. Name each problem clearly and specifically.

Avoid vague labels like “communication issues.”

Instead, use language such as: “Clients can’t identify a backup relationship manager when the primary is unavailable.”

As you review the debriefs, note which problems appear repeatedly.

If five churned clients and seven active clients mention the same issue, that’s twelve mentions of the same problem. That frequency matters.

Group similar problems together, even when clients use different words.

One client might say: “I didn’t know who to call when my manager was on vacation.”

Another might say: “There’s no backup system when my relationship manager is away.”

That’s the same problem.

To make this concrete, here are three example issues that appeared repeatedly in churned retired business owner interviews. This is not an exhaustive list. These are included only to illustrate the process.

- Unable to reach the relationship manager when they were away from work

- No visible backup when the manager was unavailable

- Clients not identified as high-net-worth when calling from US numbers

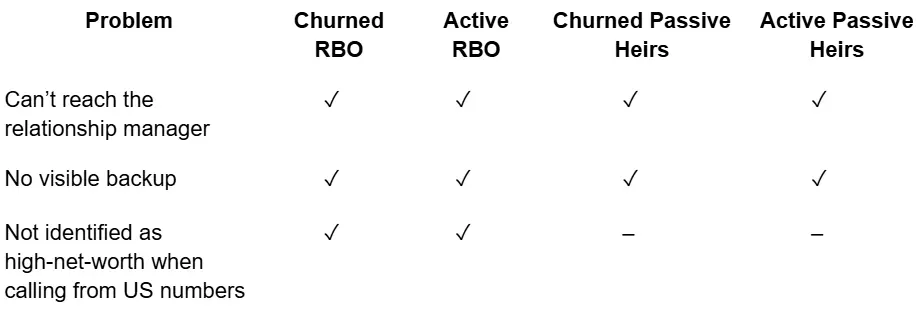

Step 2: Map problems across client segments

Create a simple matrix.

List problems on one axis and client segments on the other. Mark where each problem appears.

Problem–Segment Matrix (example)

This matrix reveals critical patterns.

Some problems affect everyone. Invisible backup coverage appeared across all four segments.

Other problems are segment-specific. The phone recognition issue appeared only among retired business owners.

Why?

Because they travel frequently, call from US numbers, and manage cross-border transactions.

Passive heirs didn’t face this problem. Their transactions are simpler and more predictable.

You only see this by mapping problems across segments.

Step 3: Prioritize problems based on client outcomes

Now look at the matrix and ask a different question.

What are clients actually trying to do?

Across every segment, one outcome stands out: clients want to reach their relationship manager.

Sometimes to approve a transaction.

Sometimes to resolve uncertainty.

Sometimes just for reassurance.

Everything else depends on that.

When the relationship manager was unavailable, authority disappeared. Context was lost. Progress stalled.

Relationship managers understand a client’s whole financial picture: assets, liabilities, family dynamics, estate plans and risk tolerance.

If clients can’t reach their manager or don’t know who to reach when the manager is unavailable, the core promise of private banking collapses.

You only know this by understanding the domain.

Without it, it’s easy to prioritize the wrong fixes. You might improve call routing or add a fancy in-app feature. Neither solves the real issue.

That’s why regulated domains require product managers with a deep understanding of the domain. You can’t prioritize problems correctly without it.

Using the matrix and the outcomes clients were trying to achieve, the priorities become clear.

1) Unable to reach the relationship manager when they’re away

This blocks the primary action clients need to take.

2) No visible or empowered backup ownership

Backup coverage existed, but clients couldn’t see it. No one had clear authority to act.

3) Not identified as high-net-worth when calling from US numbers

This issue affects retired business owners most and is closely tied to the first two problems. If clients can easily contact their relationship manager or a backup with decision-making power, the issue mostly disappears. That’s why it comes third.

Some of these problems may be solved together. But solutions come later, in the design phase.

For now, the goal is simple.

You need clarity on what to solve first, what to solve next, and what can wait.

At the start of this article, we compared interview debriefs to a kitchen before service.

All the ingredients were there. Nothing was usable yet.

You had 32 debriefs across four segments.

But stopping there would have been dangerous.

Without comparison…

You risk chasing memorable stories.

You risk prioritizing narrow issues.

You risk missing deeper patterns.

So you stepped back.

You grouped problems within each segment.

You mapped them across segments.

You prioritized them based on real client outcomes.

Now the picture is clear.

You know which problems matter most and which can wait.

The next step is to capture that clarity in one place—so it doesn’t live only in your head or your notes.

That’s where the Product Blueprint comes in.