By this point, you’ve done the hard work.

You’ve identified who is churning.

You’ve interviewed clients.

You’ve synthesized those interviews and prioritized the problems.

Before you move on to the next piece of the five-part puzzle, there’s one critical step left.

You need to communicate the problems you’ve prioritized to leadership and get buy-in.

To do that, you need to document your learnings in a single place.

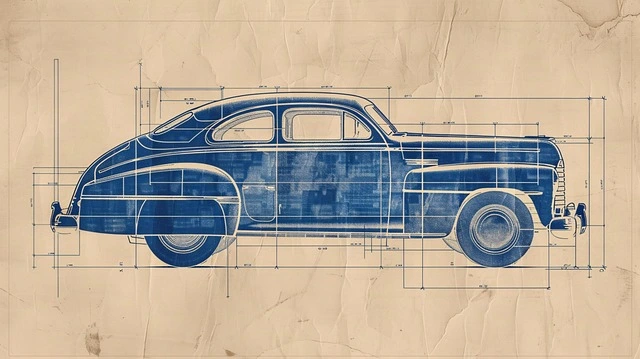

That document is what I call the Product Blueprint.

What’s a Product Blueprint?

A Product Blueprint captures all five pieces of the fintech puzzle:

- The Target Audience

- The Customer Problem

- The Solution Design

- The Solution Build

- The Launch and Iteration

It’s a living document because you update it as you move through each piece of the puzzle.

At this stage, you’ve completed The Target Audience and The Customer Problem pieces. The Product Blueprint should reflect that work.

Write the Product Blueprint as a narrative

It’s important to write the Product Blueprint as a story, not as a set of bullets or a dry document.

A narrative forces you to connect the audience, the problem, and the decisions you’ve made. When those connections are weak or missing, gaps become obvious.

Writing your work this way makes it easier to see how the pieces fit together and where they break down.

With that in mind, let’s start building our Product Blueprint.

Start with the business problem

Before you get into each piece of the puzzle, start with a high-level overview of the business problem.

There is always someone in your meetings who doesn’t fully understand the context of the feature you’re working on. Set that context first, then go deeper into each part of your fintech puzzle.

Here’s how you do that:

Churn in the high-net-worth business has increased by 10% quarter over quarter. This means 100,000 clients left in just 90 days out of one million HNW clients.

Once you’ve set the context, move on to the target audience.

The Target Audience

Retired business owners make up 45% of the client base, yet they account for 70% of churn.

The next highest churn comes from passive heirs.

Together, retired business owners and passive heirs make up 70% of the client base.

Most retired business owners fall into the high-net-worth ($500K–$5M) or very high-net-worth ($5M–$50M) segments.

When communicating with business leadership, describe these segments in terms of net worth and wealth. Speak the language they use to get alignment.

Now let’s look at the customer problem..

The Customer Problem

To understand why these clients churned, you interviewed churned retired business owners, passive heirs, and active clients from both segments.

In total, you interviewed 32 clients, six from each segment.

A clear pattern emerged.

Many retired business owners who churned had become snowbirds over the past year. They were spending extended time in the United States and building a second life there.

That shift changed their banking needs.

They needed to move large sums of money across borders more often. These transactions required approval from their relationship managers. When the manager was unavailable, transactions stalled.

Passive heirs didn’t face the same urgency. Their financial needs were more predictable and less time-sensitive, so they were comfortable waiting when their relationship manager was unavailable.

While they noticed the absence at times, it did not block critical transactions or trigger immediate churn the way it did for retired business owners.

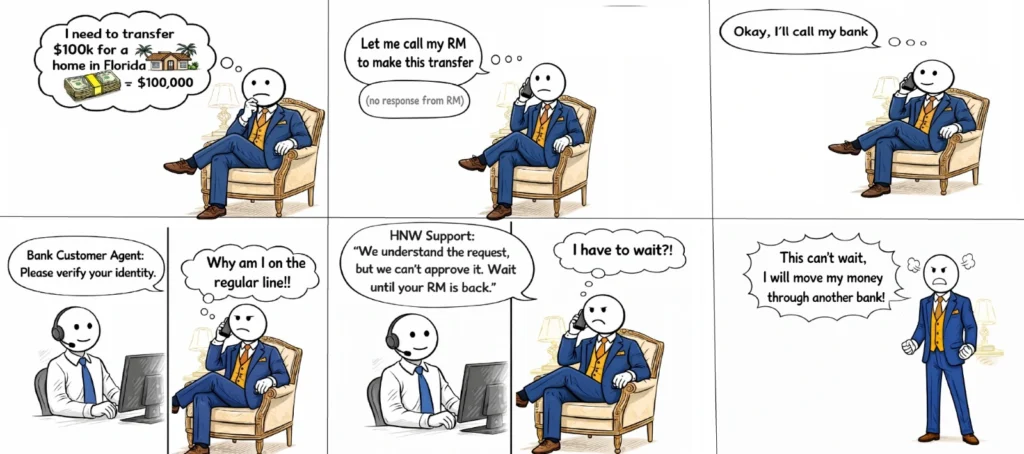

To make this real, capture the experience through a single customer story.

Here is the journey Dave, a retired business owner, went through.

All you’re doing here is turning interview insights into a customer story.

You’re focusing on the key segment: retired business owners.

If you’re working on a more complex feature with multiple segments, include one journey per segment.

You won’t see a customer journey for passive heirs because they’re not the key segment churning. Remember, retired business owners account for 70% of the churn, while passive heirs make up a much smaller portion.

Why stories work

Stories make you imagine that you are going through the journey yourself. This builds empathy for the hero of your story – your customer.

People empathize more easily with a single, identifiable person than with large abstract groups. That’s also why stories with vivid characters are remembered better than statistics and data.

Now that you know why stories work, let’s look at how many steps to include.

How many steps should the story have?

When you communicate, your audience can hold only 7±2 items in working memory. Miller’s law confirms this.

This is why you should limit the story to six steps.

The journey map should capture the key moments where customers struggle. You don’t need to describe every step in detail in the Product Blueprint.

Once the journey is clear, list the prioritized problems.

Based on the interviews, three problems surfaced repeatedly:

- Unable to reach the relationship manager when they’re away

- No visible or empowered backup ownership

- Clients not identified as high-net-worth when calling from US numbers

Remember what you started with?

You identified who is churning.

You interviewed clients.

You synthesized those interviews and prioritized the problems.

Now all of it lives in one place.

The Product Blueprint captures your target audience and the problems they face. It’s not just a deck. It’s your thinking tool. Your guide. Your way to align leadership before moving forward.

In the next post, you’ll learn how to present this blueprint to leadership and get approval to move ahead.